You were physically present in California for more than a temporary or transitory purpose.You're a resident of California if you meet one of the following criteria: Who is considered a resident? The Franchise Tax Board of California sets the residency rules. Part-year residents: All income (sourced from within or outside California) while a California resident and all income from California sources while a non-residentĪs you can see, your residency status plays a big role in determining your tax liability.Nonresidents: Any income from California sources.Residents: All income from sources within California and outside of California.Here is what gets taxed depending on your residency status:

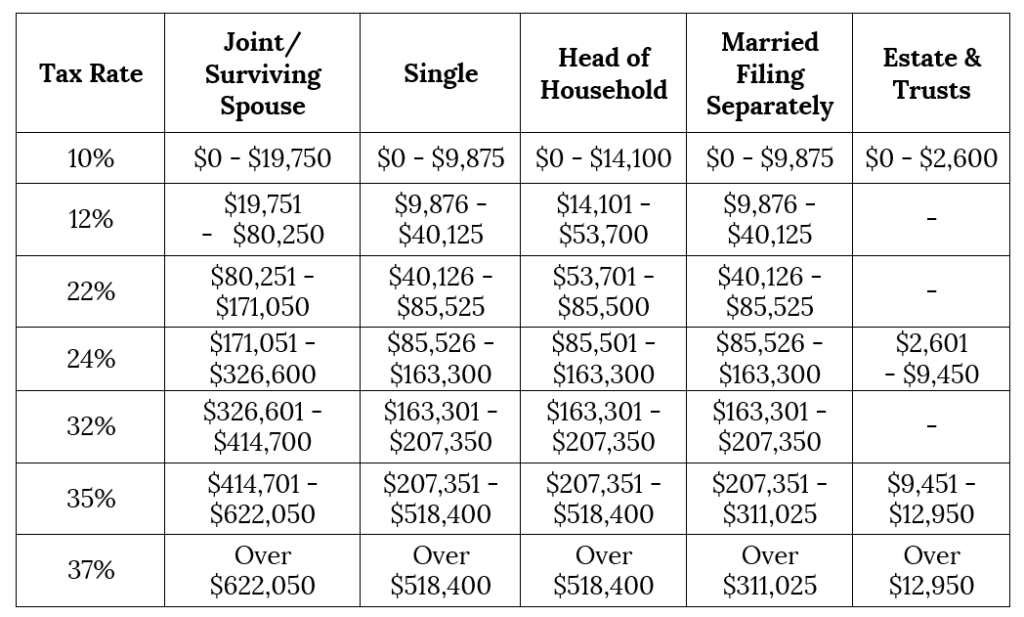

This criteria also includes three main categories of individuals: California residents, nonresidents, and part-year residents. And are required to file a federal tax return.Received income from a California source.Typically, those who need to file a California income tax return are those who: So who exactly needs to pay California state income taxes? Who Needs To Pay California State Income Tax? California taxes are used to fund state-level programs, such as public schools, Medi-Cal, social services, and more. The primary purpose of state income taxes is to raise revenue for the state government. You already pay federal taxes, why are state income taxes required as well in California?Įach state has its own set of state income tax laws. Why Are California State Income Taxes Required? Let’s take a closer look at the California state income tax rates and who owes California state taxes in 2022. This makes it important to know which income tax bracket you fall under.

Even non-residents of California are subject to California income taxes, if they make money in the state.Ĭalifornia uses a graduated-rate tax system, which means that the percentage of tax you owe increases as your income goes up. California state income taxes need to be paid by residents of California. State income taxes are levied by the state government on income earned within that state.

0 kommentar(er)

0 kommentar(er)